$GPRO GoPro cuts price of new camera for second time in 5 months

GoPro (NASDAQ:GPRO) on Friday slashed the price of its new Hero 4 Session camera for the second time in five months, hoping to stoke demand for its action cameras during the holiday shopping season.

The move came after Ambarella (NASDAQ:AMBA), which makes image processing chips for GoPro cameras, signaled weakening sales in the action camera market late Thursday. While Ambarella beat Wall Street's views for fiscal Q3 sales and earnings, it forecast sales for the current quarter below consensus estimates. Ambarella CEO Fermi Wang said that the company is facing near-term headwinds in the wearable sports market.

GoPro leads the market for wearable action cameras that capture video and still images in high resolution. But it faces increasing competition and worries about market saturation. On Friday, GoPro cut the price of its tiny Hero 4 Session camera to $199 from $299, calling the device a "game changer."

GoPro launched the Hero 4 Session on July 12 for $399. The company cut the price to $299 on Sept. 28 amid reports of sluggish sales. The Hero 4 Session is about the size an ice cube and weighs 2.6 ounces.

"The waterproof Hero 4 Session is so durable and easy to use . .. it's the perfect way to capture rough-and-tumble family activities this holiday season. From snowball fights to snowboarding, the footage will look so immersive, you'll feel like you're reliving the experience," Nick Woodman, GoPro's founder and CEO, said in a statement. "I'm stoked that for just $199, everyone can GoPro this holiday season."

GoPro stock hit an all-time low of 17.55 on the stock market today. In late morning trading, GoPro stock was down 3%, near 18. GoPro went public in June 2014 at 24 and traded as high as 98.47 in October 2014.

Robert W. Baird analyst William Power on Friday lowered his rating on GoPro stock to neutral from outperform and cut his price target to 18 from 36. He cited increasing concerns over the lack of sales growth for his decision.

$FATE Fate Therapeutics is Initiated by Wells Fargo to Outperform , according to the research report released to the investors. The shares recommendation by the Brokerage Firm was released on Dec-4-2015.

Many analysts have commented on the company rating. Raymond James initiates coverage on Fate Therapeutics, Inc. (NASDAQ:FATE) In a research note issued to the investors, the brokerage major announces a price-target of $8 per share.The shares have been rated Outperform. The rating by the firm was issued on October 6, 2015.

The company shares have rallied 8.27% from its 1 Year high price. On May 6, 2015, the shares registered one year high at $8.78 and the one year low was seen on Oct 22, 2015. The 50-Day Moving Average price is $4.29 and the 200 Day Moving Average price is recorded at $5.97.

Shares of Fate Therapeutics, Inc. (NASDAQ:FATE) ended Tuesday session in red amid volatile trading. The shares closed down 0.01 points or 0.24% at $4.18 with 80,729 shares getting traded. Post opening the session at $4.21, the shares hit an intraday low of $4.1 and an intraday high of $4.235 and the price vacillated in this range throughout the day. The company has a market cap of $120 million and the number of outstanding shares have been calculated to be 28,716,570 shares. The 52-week high of Fate Therapeutics, Inc. (NASDAQ:FATE) is $8.781 and the 52-week low is $3.1235.

Fate Therapeutics, Inc. (NASDAQ:FATE): 4 Brokerage firm Analysts have agreed with the mean estimate for the short term price target of $9.75 in Fate Therapeutics, Inc. (NASDAQ:FATE). However, the stock price could fluctuate by $ 1.26 from the estimate as it is suggested by the standard deviation reading. The higher estimate has been put at $11 price target with the lower price estimate is calculated at $8.

Currently the company Insiders own 17.43% of Fate Therapeutics, Inc. shares according to the proxy statements. Institutional Investors own 63.91% of Fate Therapeutics, Inc. shares.

Fate Therapeutics, Inc, is a clinical-stage biopharmaceutical company engaged in the discovery and development of pharmacologic modulators of adult stem cells to treat orphan diseases, including hematologic malignancies, lysosomal storage disorders and muscular dystrophies. Its approaches utilize pharmacologic modalities, including small molecules and therapeutic proteins, and biological mechanisms to enhance the therapeutic potential of adult stem cells.

$TRVN Trevena Announces FDA Grant of Fast Track Designation to Oliceridine (TRV130)

Trevena, Inc. (NASDAQ: TRVN), a clinical stage biopharmaceutical company focused on the discovery and development of biased ligands targeting G protein coupled receptors, today announced that the United States Food and Drug Administration (FDA) has granted Fast Track designation to oliceridine (TRV130) for the management of moderate-to-severe acute pain. Oliceridine is being developed as a potential replacement for currently approved intravenous opioid analgesics. In a recently completed Phase 2 study in postoperative pain, oliceridine matched the analgesic efficacy of morphine with an improved safety and tolerability profile. Trevena expects to initiate Phase 3 development of oliceridine in the first quarter of 2016.

Ascent Solar Awarded GSA Schedule 56; Products, Including MilPak E, Now Available for Purchase by the US Government

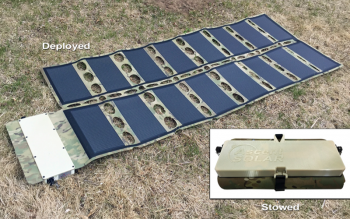

THORNTON, CO and WASHINGTON, DC--(Marketwired - Dec 2, 2015) - Ascent Solar Technologies, Inc. (NASDAQ: ASTI), a developer and manufacturer of state-of-the-art, flexible thin-film photovoltaic modules integrated into the company's EnerPlex™ series of consumer products, announced today the Company was awarded a Schedule 56 contract, beginning December 15th, 2015, by the General Services Administration (GSA), the procurement division of the United States Federal Government.

The contract enables Federal customers, including all four branches of the U.S. Military, Federal Agencies and others, to easily purchase a range of Ascent Solar products including: the MilPak E and EnerPlex products such as the Kickr IV and Kickr II.

"Ascent's GSA Schedule 56 contract unlocks a large and previously untapped potential revenue opportunity. The military applications for Ascent's lightweight and durable solar products are numerous, particularly considering the MilPak platform; but there are a multitude of other applications for Ascent's products ranging from disaster relief to use by the U.S. Forest Service," said Rafael Gutierrez, Senior Vice President and COO of Ascent Solar.

The granting of the GSA Schedule 56 contract is the result of a rigorous process. The GSA carefully assesses companies to determine their ability to deliver products and/or services to the Federal Government on a sustained basis. The completion of this process identifies the recipient as a preferred vendor for the Federal Government and one which is authorized to conduct commercial operations directly with Federal Agencies.

Beginning December 15th, Federal, State and local agencies may obtain information about Ascent Solar GSA Schedule 56 products at www.gsaadvantage.gov (search for Solicitation No. 7FCI-F8-03-0056-B) or by contacting Ascent Solar via This email address is being protected from spambots. You need JavaScript enabled to view it..

About Ascent Solar Technologies and EnerPlex:

Ascent Solar Technologies, Inc. is a developer of thin-film photovoltaic modules with substrate materials that are more flexible, versatile and rugged than traditional solar panels. Ascent Solar modules can be directly integrated into consumer products and off-grid applications, as well as aerospace and building integrated applications. EnerPlex is the Company's brand of consumer products and is a division of Ascent Solar. Ascent Solar and EnerPlex are headquartered in Thornton, Colorado. For more information, go to www.goenerplex.com and www.ascentsolar.com.

$AVXL Anavex Expands Management Team

NEW YORK, Dec. 02, 2015 (GLOBE NEWSWIRE) -- Anavex Life Sciences Corp. (“Anavex” or the “Company”) (AVXL), a clinical-stage biopharmaceutical company developing drug candidates to treat Alzheimer’s disease, other central nervous system (CNS) diseases, pain and various types of cancer, today announced the appointment of Ulrich Elben, PhD as Vice President of Preclinical Operations. In this new role, Dr. Elben will oversee the pipeline development and optimization.

“What attracted me to join Anavex is the very impressive pipeline consisting of potential breakthrough therapies for indications with very high unmet medical need like Alzheimer’s disease and other indications having potential beneficial impact on patients' lives,” said Ulrich Elben, PhD.

“We are pleased to welcome Dr. Elben to Anavex during this exciting time in our growth. He has both experience and a shared passion for bringing promising drug candidates through the development cycle to market in an effort to serve patients with devastating diseases,” said Dr. Christopher U. Missling, PhD, President and Chief Executive Officer for Anavex. “His expertise in the management of multidisciplinary programs is expected to add valuable depth to our team.”

Dr. Elben joins Anavex with extensive experience in global pharmaceutical development and research. His background includes roles as VP of Strategic Development Operations at Vertex Pharmaceuticals, with responsibilities including project and portfolio management as well as the development of an oncology project. In addition Dr. Elben served as a member of the Vertex drug development advisory board and drug product review committee. He was also Chief Development Officer at Avaant Pharmaceuticals, where he led the development of oncology projects across the USA, Europe and India. Earlier in his career, Dr. Elben was CEO of Axxima Pharmaceuticals in Munich, Germany.

Dr. Elben started his career with Sanofi-Aventis (former Hoechst Marion Roussel) in Europe and the USA, where his last position was deputy head of project management overseeing also Alzheimer’s and schizophrenia products. He and his teams were successful at bringing several drugs through the international development cycle and ultimately to market. Dr. Elben was also secretary of the Sanofi-Aventis drug development review committee.

Additionally, Dr. Elben has extensive, recent consulting experience with VCs, biotech companies and API manufacturing companies in the USA, Canada and Europe. He is currently a member of several organizations, including the CEO advisory board of the Florida Institute for the Commercialization of Public Research, BioFlorida and the Drug Information Association.

Dr. Elben received his PhD in organic chemistry from the University of Bonn, Germany.

About Anavex Life Sciences Corp

Anavex Life Sciences Corp. (AVXL) is a publicly traded biopharmaceutical company dedicated to the development of novel drug candidates to treat central nervous system (CNS) diseases and various types of cancer. Anavex’s lead drug candidates, ANAVEX 2-73 and ANAVEX PLUS, the combination of ANAVEX 2-73 and donepezil (Aricept®), are currently in a Phase 2a clinical trial for Alzheimer’s disease. The drug combination ANAVEX PLUS produced up to 80% greater reversal of memory loss in Alzheimer’s disease models versus when the drugs were used individually. ANAVEX 2-73 is an orally available drug candidate that targets sigma-1 and muscarinic receptors and successfully completed Phase 1 with a clean data profile. Preclinical studies demonstrated its potential to halt and/or reverse the course of Alzheimer’s disease. It has also exhibited anticonvulsant, anti-amnesic, neuroprotective and anti-depressant properties in convulsive epileptic animal models, indicating its potential to treat additional CNS disorders, including epilepsy and others. Michael J. Fox Foundation (MJFF) for Parkinson’s Research has awarded Anavex a research grant to develop ANAVEX 2-73 for the treatment of Parkinson’s disease to fully fund a preclinical study, which could justify moving ANAVEX 2-73 into a Parkinson’s disease clinical trial. ANAVEX 3-71, also targeting sigma-1 and M1 muscarinic receptors, is a promising preclinical drug candidate demonstrating disease modifications against the major Alzheimer’s hallmarks in transgenic (3xTg-AD) mice, including cognitive deficits, amyloid and tau pathologies, and also with beneficial effects on neuroinflammation and mitochondrial dysfunctions. Further information is available at www.anavex.com.

Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: OraSure Technologies, Inc. (NASDAQ:OSUR).

OraSure Technologies, Inc. (NASDAQ:OSUR) was in 25 hedge funds’ portfolios at the end of September. OSUR has seen an increase in hedge fund interest in recent months. There were 21 hedge funds in our database with OSUR positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity, but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Innocoll AG (NASDAQ:INNL), Electro Rent Corporation (NASDAQ:ELRC), and HENNESS CAPITAL ACQUISITION CORP II (NASDAQ:HCAC) to gather more data points.

To most shareholders, hedge funds are viewed as slow, old investment vehicles of years past. While there are over 8000 funds with their doors open at the moment, Our researchers choose to focus on the crème de la crème of this club, about 700 funds. These money managers manage most of the smart money’s total capital, and by tracking their matchless stock picks, Insider Monkey has formulated a number of investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s small-cap hedge fund strategy outstripped the S&P 500 index by 12 percentage points a year for a decade in their back tests.

Shares of Fitbit Inc. FIT, +4.17% climbed nearly 4% in premarket trade Monday after the stock was upgraded to overweight from equal weight at Barclays. While shares of Fitbit have fallen 26% over the last 30 days, compared with a 1.2% increase for the S&P 500, Barclays analyst Matt McClintock called the sharp decline unjustified and said the company has proven to have strong metrics despite competition concerns. The analyst maintained a $49 price target on the stock, and shares of Fitbit were on track to open around $28.93 on Monday. Despite fears that Fitbit would struggle with the release of the Apple Watch AAPL, +0.61% which has also been marketed as a fitness device, Fitbit's revenue growth rate accelerated in the second and third quarters compared with the same quarters in 2014 before the watch's release, said McClintock. This holiday season is also a positive catalyst, he said, with sales of fitness wearables off to a strong start and Fitbit remaining one of the most sought-out brands.

Voltari Shares Crashing; This Investor Is Still Short On 'Ridiculous' Price Action

Shares of Voltari have surged nearly 75 percent over the past five days alone, adding to the nearly 1,000 percent surge year-to-date. The provider of merchandising, digital marketing and advertising solutions, announced an entry into the real estate investment business.

Voltari in August that it has already began implementing a business transformation in which it will exit the mobile marketing and advertising business. The company will now focus on acquiring, financing and leasing commercial real estate properties. In addition, management will also "explore additional strategic opportunities from time to time, which may include opportunities with respect to its intellectual property, investments in various industries or acquisitions.

"BUYER BEWARE!," The Street Sweeper's Sonya Colberg in a report on Tuesday. "Growth? No!"

Colberg suggested that investors "must watch out" for this stock with a market cap of just barely $60 million as of Wednesday. Colberg's main issue with the company is the fact that it "only" has $2.5 million in cash and the company will need to raise funds and will "likely" take advantage of the recent surge in its stock price to issue additional stock.

"Dilution appears imminent," the report concluded. "Don't get stuck holding de-valued shares."

Aeterna Zentaris Affirms Fundamental Strength of Business

- Zoptrex™ (zoptarelin doxorubicin) recently received DSMB recommendation to continue the ZoptEC Phase 3 clinical program to completion following review of the final interim efficacy and safety data

- Zoptrex™ met Phase 2 Primary Endpoint in men with heavily pretreated castration- and Taxane-resistant prostate cancer

- First patient enrolled in the confirmatory Phase 3 clinical trial of Macrilen™

- Promotion of Saizen® and EstroGel® by the Company's sales force continues to show promise

Dilution from Series B Share Purchase Warrants has been substantially eliminated Commenting about the fundamentals of the Company's business, Chairman, President and Chief Executive Officer David A Dodd stated, "Yesterday's announcement regarding corporate developments, which was required by IIROC on behalf of the Toronto Stock Exchange, caused some to question the fundamentals of our business. I want to reiterate that we believe the fundamentals remain strong. We have two products in Phase 3. One of the products, Zoptrex™, is in the late stage of Phase 3. We instituted a confirmatory Phase 3 clinical trial of Macrilen™ after a panel of US and EU endocrinology experts advised us to continue to seek approval for the compound because of their confidence in its efficacy and because there currently is no FDA-approved diagnostic test for adult growth hormone deficiency. That Phase 3 study recently enrolled its first patient, keeping us on track to conclude it by the end of 2016."

Mr. Dodd also commented on the Company's business development efforts, saying "We continue discussions with others about adding to our portfolio of promoted products and about the commercial rights to and development of Zoptrex™ in markets outside the United States. Of course, our business is subject to the risks inherent in the development of biopharmaceuticals. But we are successfully moving forward with activities intended to create long-term value for our shareholders. We are confident in our activities and believe we are achieving the necessary progress to build significant value for our shareholders, employees and the medical providers and patients who will benefit from our developing portfolio."